Telephone Number Here

Telephone Number Here

Fostering growth through a passion for learning, unwavering loyalty, nurturing care, and adventurous exploration.

Why Choose Little Learner Children's Academy For Child Care?

At Little Learner Children's Academy, everything we do is centered around fostering a love for learning and creating a vibrant, engaging environment where children thrive.

It’s our mission to cultivate the next generation of curious, confident, and culturally aware learners

through enriched early childhood education programs.

Careers

Apply today and find out more about our amazing career opportunities and join our team!

Welcome to

Little Learner Children's Academy

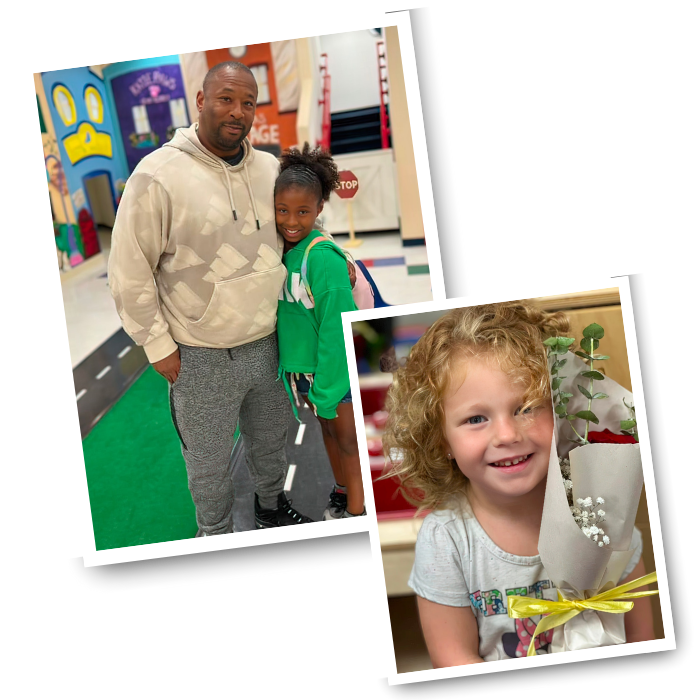

At Little Learner Children's Academy, we believe that every child is a unique learner, filled with endless potential and curiosity. Since our establishment, we’ve been dedicated to providing high-quality early childhood education that fosters intellectual, emotional, and social growth.

Our mission:

Our mission at Little Learner Children’s Academy is to provide exemplary childcare by offering a program tailored to ensure high-quality daily experiences for each child.

Join us for a fun-filled Trunk or Treat Open House this October!

If you’re thinking of enrolling your child for the upcoming school year, this is the perfect opportunity to explore our full-day learning programs, meet our caring team, and discover how we can support your child’s learning journey - all while enjoying a festive fall event with the whole family.

Privacy Policy | Copyright © 2024 Little Learner Children's Academy